How to Build a Diversified Portfolio for Sustainable Retirement Income in 2026

Planning for a financially secure retirement is one of the most important aspects of long-term investing. With the ever-changing economic conditions and market dynamics, 2026 presents new challenges and opportunities for retirees and future retirees alike. Diversification remains a crucial strategy to ensure sustainable income throughout retirement years.

Why Diversification Matters for Retirement Income

Diversification is the practice of spreading your investments across various asset classes, sectors, and geographical locations to reduce risk and optimize returns. In the context of retirement, diversification helps protect your income streams from market volatility, inflation, and unexpected economic shifts.

Understanding Asset Classes

Building a diversified portfolio begins with understanding the primary asset classes:

- Stocks: Equities often provide growth potential through capital appreciation and dividends. Including stocks from different sectors and geographies can help mitigate risks.

- Bonds: Fixed income securities offer regular interest payments, which can serve as a stable income source. Diversify bonds by type (government, corporate), duration, and credit quality.

- Real Estate: Real estate investment trusts (REITs) or direct property investments can provide income through rents and potential appreciation.

- Cash and Cash Equivalents: While offering lower returns, they provide liquidity and safety, crucial for covering short-term needs.

- Alternative Investments: These include commodities, hedge funds, or private equity, which can enhance diversification through low correlation with traditional assets.

Steps to Build a Diversified Retirement Portfolio in 2026

1. Define Your Retirement Income Goals

Understanding your income needs after retirement is foundational. Estimate your expenses, inflation considerations, healthcare costs, and lifestyle desires. This clarity enables tailored portfolio construction.

2. Assess Your Risk Tolerance and Time Horizon

While retirement might be close for some, others have decades to invest. A balanced approach should consider how much risk you can tolerate and how long your money needs to last.

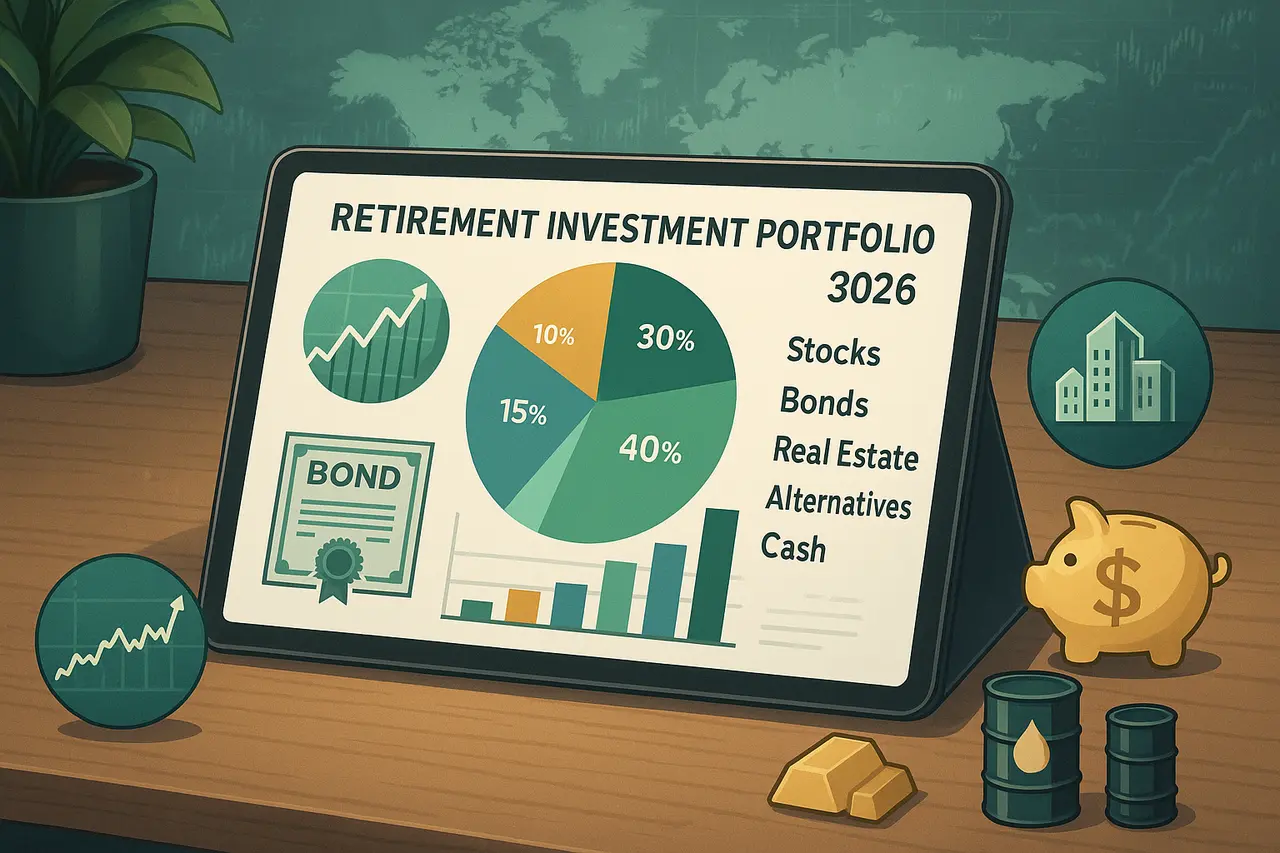

3. Allocate Across Asset Classes Strategically

In 2026, market trends suggest maintaining a moderate allocation towards equities for growth, a solid allocation to bonds for income, and some exposure to real estate and alternatives to hedge against inflation and market downturns.

4. Diversify Within Asset Classes

Diversification is not just about asset classes but also about geographic and sector allocation. For example, investing in international stocks or bonds can provide access to growth in emerging markets and reduce home-country bias.

5. Incorporate Sustainable and ESG Investments

Environmental, Social, and Governance (ESG) criteria are increasingly relevant. ESG-focused funds can encourage sustainable business practices while potentially improving long-term performance.

6. Periodically Rebalance Your Portfolio

Market movements can shift your allocations. Reviewing and rebalancing ensures your portfolio remains aligned with your risk profile and retirement goals.

Effective Income Strategies for Retirement

- Dividend-Paying Stocks and Funds: These can generate a growing income stream.

- Bond Ladders: Staggering bond maturities can provide predictable income.

- Annuities: Can offer guaranteed income but be sure to evaluate fees and terms.

- Withdrawal Strategies: Safe withdrawal rates, such as the 4% rule, should be adapted based on market conditions.

Maintain Control with Smart Financial Tools

Managing a diversified portfolio requires continuous monitoring and adjustments. Using advanced budgeting and finance management tools can empower retirees and investors to have a comprehensive view of their finances. The Budget IQ Pro is an intelligent financial system designed to provide total control over personal finances, enabling smarter investment decisions and sustainable income management for retirement.

Learn More and Take Control of Your Retirement Finances

To deepen your understanding of managing personal finances and investments, explore resources that provide strategies for retirement planning and long-term investing principles. These insights, combined with the right tools, can help ensure a comfortable and financially stable retirement.

For practical advice on budgeting and finance control tailored to retirees and pre-retirees, visit budgeting tips for retirees which complements your investment strategy.

Conclusion

Building a diversified portfolio is essential for achieving sustainable retirement income, especially in 2026’s dynamic financial environment. By defining clear goals, understanding risk tolerance, allocating assets wisely, and using comprehensive financial tools like Budget IQ Pro, retirees can optimize income and enjoy peace of mind during their retirement years.